It took me a while to recall how to calculate the maximum amount of Additional Wage (AW) subject to CPF contribution for the year. As there are many changes in CPF for the next 3 years, I would like to pen down the information before I forget again.

The CPF Ordinary Wage ceiling had been increased in September 2023 and January 2024.

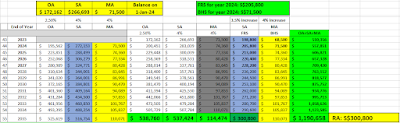

Hence, the total CPF contribution (37%) had been increased from S$2,220 to S$2,331 and S$2,516. It will continue to increase to S$2,738 in year 2025 and S$2,960 in year 2026.

CPF Ordinary Wage ceiling is Singapore happy index. So, the new Singapore happy index will be S$8,000 a month. :)

The CPF annual salary ceiling remains unchanged at S$102,000. This is my bet, the CPF annual salary ceiling shall be increased in year 2026, let's see.

For year 2024, if your monthly salary is S$6,800 and above, the CPF system will automatically calculate in the following:

S$6,800 x 12 months = S$81,600

As CPF annual salary ceiling is S$102,000, you left the balance of:

S$102,000 - S$81,600 = S$20,400

The magic number S$20,400 is applicable to every CPF members if you earn monthly S$6,800 and beyond.

As my company always gives bonus in April, the maximum amount of Additional Wage (AW) that will attract CPF contribution will only be S$20,400. That says, even if your bonus is S$30,000 or S$50,000, it will still cap at the maximum CPF contribution at S$20,400.

S$20,400 x 0.37 = S$7,548 (maximum allowed additional wage CPF contribution)

+ S$6,800 x 0.37 = S$2,516 (maximum allowed monthly CPF contribution)

= S$10,064 (that's the maximum CPF contribution you see in the bonus month).

Thereafter, your 13th month bonus given in December will not attract any CPF contribution too!

In addition, you have reached the maximum tax relief of S$20,400 under personal reliefs category of Providend Fund/Life Insurance.