Revision 10 (last paragraph): updated on January 1, 2024

Revision 09: updated on January 1, 2023

Revision 08: updated on January 1, 2022

Revision 07: updated on January 1, 2021

Revision 06: updated on April 11, 2020

Revision 05: updated on Jan 7, 2020

Revision 04: updated on Feb 22, 2018

Revision 03: updated on June 09, 2017

Revision 02: updated on March 29, 2016

The Government actually gives all new-born who are Singapore Citizens born on or after 26 August 2012 a S$3,000 grant in the CPF Medisave account. If your child was born earlier than 26 August 2012 but the EDD (Expected Delivery Date) was fall on 26 August 2012 or later. You can appeal and you will receive this free grant from the Government too. Take note, don't give up. :)

Only recently, I realize you can fill up the MAC FORM 4 for an Application by Parent to View Child's Statement Online.

It is interesting to know an age 1 baby had already had a CPF account. And now at the age of 2, he already accumulated S$3,209 because Medisave account gives 5% interest per year (until your account hit S$60,000 cap).

The online application will be processed in 5 working days.

Revision 05: updated on Jan 7, 2020

Revision 04: updated on Feb 22, 2018

Revision 03: updated on June 09, 2017

Revision 02: updated on March 29, 2016

The Government actually gives all new-born who are Singapore Citizens born on or after 26 August 2012 a S$3,000 grant in the CPF Medisave account. If your child was born earlier than 26 August 2012 but the EDD (Expected Delivery Date) was fall on 26 August 2012 or later. You can appeal and you will receive this free grant from the Government too. Take note, don't give up. :)

Best of all, my kid was born 8 days after this news released. So, my son was one of the first batch of babies receiving this gift from the Government. The last S$1,500 deposit was received on December 4, 2013. I believe many parents had received this letter.

Only recently, I realize you can fill up the MAC FORM 4 for an Application by Parent to View Child's Statement Online.

After the linkage of the account, you can view your child CPF statement online.

It is interesting to know an age 1 baby had already had a CPF account. And now at the age of 2, he already accumulated S$3,209 because Medisave account gives 5% interest per year (until your account hit S$60,000 cap).

With compound interest calculation, this S$3,000 gift from the Government will turn into S$43,906 in his Medisave account by the time he hits age 55. I strongly advise parents not to use this CPF MA money to pay for his vaccination , just let the money rolls in the account wit the interest.

This is the power of compound interest.

Updated on March 29, 2016

====================

We decided to top up our kid CPF account by S$2,000 per year until we are at the age of 55. By then, he will be at the age of 23!

S$1,000 per year each from me and my wife is not a big sum, but it can be a great help for him later.

It is good to know by doing S$2,000 CPF SA top-up per year for 20 years (total would be S$40,000), his account will have S$268,321 at his age of 55. :) Probably this would be a great help for him to meet the higher Minimum Sum by then.

Do take note I am using 5% interest as calculation until S$60,000 cap, thereafter the interest will be 4% just as the current CPF interest rate distribution.

How to do it?

Below is the email I received from CPF board. :)

For members aged below 55 like your child, he can receive cash top-ups to his Special Account (SA) at any time (multiple times in a year), as long as he has the available topping-up limit in his SA. The maximum amount that he can commit to his SA is the prevailing Full Retirement Sum (FRS) of the particular year. The FRS currently from 1 July 2015 to 31 December 2016 is $161,000.

To submit the topping-up application via our online services, please:

1) Log in to my cpf Online Services with your SingPass.

2) Select “My Requests” on the left-hand navigation menu.

3) Select “Building Up My/My Recipient’s CPF Savings (eg. Transfer OA to SA savings, Topping up to my RA, CPF Minimum Sum Topping-Up Scheme, etc)”.

4) To make a cash top-up, click on this option on the screen and follow the instructions to submit the topping-up application.

For recipient below 55:

Contribute to my / my recipient's Special Account via

internet banking using e-cashier | OCBC's Internet Banking | cheque#

5) If you have chosen the intended payment mode as OCBC’s Internet Banking, please follow the steps below:

a) Select "Log on to Internet Banking" at www.ocbc.com.sg.

b) Under "Payments & Transfer", select "Pay Bills".

c) Select “Single Bill Payment” from the list of services available.

d) Under "Pay billing organisation", select "CPF BOARD" as the billing organisation and key in the bill reference no. 1 .

e) Key in the amount, payment date and select the bank account.

f) Click next and submit.

6) You can also make the payment at any OCBC ATM Machines:

a) Select “More services”.

b) Select “Bill payment”.

c) Select “Pay to Govt/Stat Board”.

d) Enter the amount.

e) Select CPF Board by keying in “2191”.

f) Enter the “Bill Reference No.” 1.

g) Continue to the next screen and confirm the transaction.

1The Bill Reference No. is indicated in the topping-up application form which was submitted in Step 4.

Please make payment immediately at OCBC Personal Internet Banking/Mobile Banking or ATM after you have submitted the application as payment through OCBC Bank may take up to 3 working days to reach us. If the payment is not received within 3 working days, the application will be considered unsuccessful.

Updated on June 09, 2017

====================

During the lunch, I often heard fresh graduate engineers complaining about no money in the bank account. They don't have money to pay for the down payment of BTO flat and yet they have to clear their student loan debts every month. That is very sad. It is a tough start for the young people nowadays if they don't get helps from their parents at all.

I decided to do something extra for my little one. I just top up another S$1,000 to his CPF SA account to enjoy 5% compound interest.

I now pledge to top up S$3,000 total yearly into his CPF SA account for the next 18 years. I started with 20 years top up plan with S$2,000 yearly initially. With the new top up figures, by his age of 23, he will have S$108,941 in his CPF account. I hope this can be a good kick start for him to start his career life.

Take note, the first S$60,000 in the CPF SA account will enjoy 5%, the balance will enjoy 4%.

So, in the table below, when you hit S$63,458.87 in the age of 17, the interest calculation formula would be:

(S$63,458.87 - S$60,000) x 0.04 + (S$60,000 x 0.05)

Updated on February 22, 2018

======================

I changed my mind. I now pledge to top up S$4,000 total yearly instead due to the 9% GST increment news. Just kidding.

I will top up until his age of 24, that's about his time to start working at the society and he can have a CPF balance of S$148,685 when he starts to work. He can't use the money for housing as it will be all in SA and MA account.

With only these amounts, top up of S$82,000 total for 21 years, the value will increase to S$537,133 when he reaches the age of 55. This amount excludes his own CPF contribution while he starts to work. So, half a million gift from me for his age of 55.

555% return, not bad. I like the figure.

His CPF balance (at the age of 5) now stands at S$14,010.44.

Updated on January 7, 2020

=====================

We received total CPF interest of S$1,009.67 (SA: S$814.67 & MA S$195) for year 2019.

I just top up S$4,185.33 this year to make the balance of SA to be S$22,000.

I expect the CPF interest of S$1,300++ for year 2020.

The power of compound interest of 5.0%.

His CPF balance (at the age of 8) now stands at S$26,096.59.

FRS for year 2022 is S$192,000.

Conservatively with S$5,000 increment per year in FRS, by the time my son reaches age 55, his FRS will be S$417,000. That is a massive amount!

Updated on April 11, 2020

=====================

Just used my yearly bonus to top up his SA account by another S$2,000.

The new balance now, SA: S$24,000, MA: S$4,095.69.

SA + MA = S$28,095.69

The simulation table below was updated accordingly. It assumes S$4,000 a year CPF top up into his SA account until his age of 24.

These top up will turn into S$568,160.78.

With SA deduction of S$417,000 to form the FRS figure in the CPF RA account, he will have extra cash of S$151,160.78 to withdraw at the age of 55.

His FRS (by his age of 55) would be S$417,000 and the monthly payout at the age of 65 would be S$3,336.

All these figures exclude his own CPF contribution in the future while he starts to work.

Updated on January 1, 2021

=====================

On the first day of the new year 2021, I topped up my kid CPF SA account to make the balance flat at S$32,000. Expected SA interest on Dec 31, 2021, shall be S$1,600.

Happy New Year 2021 ~

Updated on January 1, 2022

=====================

I am grooming one little CPF warrior. LOL.

On the first day of the new year 2022, I topped up S$6,428.44 to my kid CPF SA account to make the SA account balance flat at S$40,000.

Do use PayNow payment mode, not eNETS as PayNow is done instantly. Use only PayNow!

Expected SA account interest on Dec 31, 2022, shall be S$1,964.45.

Happy New Year 2022 ~~~

Updated on January 1, 2023

=====================

On the first day of the new year 2023, I topped up S$8,026.85 to my kid CPF SA account to make the SA account balance flat at S$50,000.

Do use PayNow payment mode, not eNETS as PayNow is done instantly. Use only PayNow!

The (SA+MA) interest on Dec 31,2023 shall be S$2,737.05

Happy New Year 2023 ~~~

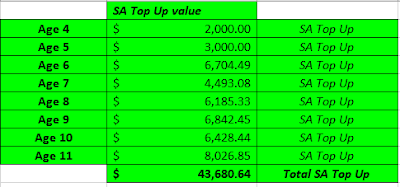

The CPF SA Top Up journey since year 2016.

In Summary, total S$43,680.64 CPF SA top up.

Total CPF interest (SA+MA) + government gift received: S$11,060.41.

Total CPF balance (SA+MA): S$54,741.05 (age 11)

Updated on January 1, 2024

=====================

On the first day of the new year 2024, I topped up S$7,527.16 to my kid CPF SA account to make the SA account balance flat at S$60,000.

Do use PayNow payment mode, not eNETS as PayNow is done instantly. Use only PayNow!

Happy New Year 2024 ~~~

No comments:

Post a Comment